IMPORTANT: This article is outdated. The most up to date information on Payment Gateways in Namibia can be found here.

IMPORTANT: Peach Payments is NOT available to Namibians. Peach Payments can only service users with South African Bank Accounts. This is likely to change in the future, but there is no ETA available. Keep an eye on this page as we will post an update here the moment they can pay out to Namibian bank accounts.

Lately I've been talking a lot about Payment Gateways and how unfortunately Namibians are only left with 2Checkout.com as an option when it comes to payment gateways. I'm happy to announce that another player has entered the market and offers a really amazing solution. They not only offer support for Namibian bank accounts but also offer some really nifty extras that will even make non-Namibians want to consider switching.

Important Note: For those that don't know, the current exchange rate is: N$1.00 (1 Namibian Dollar) = R1.00 (1 South African Rand). 1 US Dollar is roughly 12 Namibian Dollars.

Firstly, what does a Payment Gateway need in order to work in Namibia?

The biggest problem with payment gateways is redeeming the payments into a Namibian bank account. Until today and as far as I've come across, only 2Checkout has offered a decent solution to the problem of depositing money into Namibian bank accounts. However, 2Checkout doesn't require a merchant account. This is probably why the fees are so high. Therefore, in order to receive payments effectively using a proper payment gateway, you need:

- A merchant account with a bank

- A bank account with a bank account that is supported by the bank where the merchant account resides

If you can get a bank account in another country, the solution I propose is less impressive, as there are loads of other payment gateways that would work for non-Namibian bank accounts. However, if you can't get a bank account outside of Namibia or if you want a payment gateway that can allows payments on your site without leaving your website, read on.

So which payment gateway should I use?

*drum roll* ..... you should be using Peach Payments.

But how do I get the merchant account if my bank doesn't support it?

Peach Payments will assist you in opening a merchant account with Nedbank in Namibia. In other words, even though you might be banking with Bank Windhoek or FNB, once you start the application process through Peach Payments, they will tell you what is required and help you get a merchant account with Nedbank, who in turn can then deposit funds directly into your Namibian or non-Namibian bank account.

But I don't bank with Nedbank?

No problem. Nedbank only gives you the merchant account. When you receive a payment, the money is still transferred into any Namibian bank account you choose. Of course, they also support many other banks from different countries, but this is great news for Namibians who, until now, have had very limited payment gateway options.

What fees can I expect to pay?

Note: These rates are as I received them today (17 February 2015) and are likely to change over time. If you are reading this and it's no longer 2015, you might be better off asking Peach Payments for their latest rates.

Peach Payments currently charge N$ 300.00 per month for a normal transacting account and optionally an additional N$ 200.00 per month if you wish to make use of their recurring payments services. Most users would probably opt for the N$300.00 per month account, unless you offer several services that require monthly billing.

Peach Payments then also charges a fixed transaction fee of N$1.50 per transaction. However, various discounts will apply if you do more than 3000 transactions per month, making it even more affordable as your business grows.

The final fee associated with using a payment gateway is a fee charged by your bank for the merchant account. This fee can also vary depending on a couple of factors such as the number of transactions you do per month and the average value of each transaction. Expecting 3.5% is not unrealistic, but lower than that could possibly be obtained, depending on your relationship with your bank.

Is it cheaper than 2Checkout (and other Payment Gateways)?

Peach Payments generally works out to have the same cost as MyGate, Setcom etc. Their monthly fees all range in the N$200 - N$500 bracket, with transaction fees generally being around N$1.50. 2Checkout, on the other hand, is significantly more expensive. That means if you have a Namibian bank account and your choices are between 2Checkout and Peach Payments, you are better off using Peach Payments.

To demonstrate why Peach Payments is cheaper, I am going to do an example where I assume that you do 20 transactions each month, with a value of N$500.00 per transaction, giving you a total income of N$ 10 000.00 per month.

With 2Checkout, if you had to do 20 transactions per month with a value of N$500 per transaction, you would have the following fees:

- 5.5% of total value: 5.5% of N$10 000 = N$550

- 0.45 US cents per transaction fee: 20 x 0.45 US Cents = N$108

- 10USD per N$3600 withdrawn: +-30 USD which is equal to roughly N$360

Total cost if using 2Checkout: N$ 1018

In other words, of the N$10 000 that you were supposed to get, you lost 10.2% of your income.

Now let's look at what it would've cost you with Peach Payments:

- 3.5% of total value for transaction fee: 3.5% of N$10 000 = N$350

- N$1.50 per transaction fee: 20 x N$1.50 = N$30

- N$300 monthly fee

Total cost if using Peach Payments: N$ 680

In other words, of the N$10 000 that you were supposed to get, you lost 6.8%.

That is a 3.4% saving with Peach Payments! Or, N$338.00.

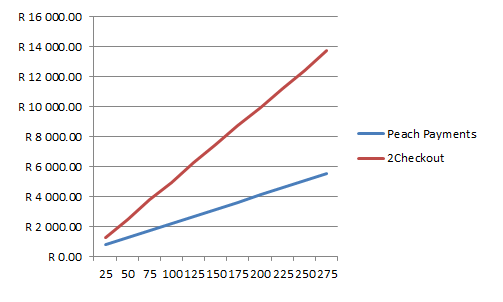

Things get even more interesting when you look at more transactions:

Savings are very little when you are doing less than 500 Transactions, but the moment it starts going over, the savings become significant. If your business ends up doing 50 000 transactions a month, you would have lost 1.5 Million Namibian Dollars. That is a lot of money to lose if you think you can save so much just by switching payment gateways!

Here is more linear representation with smaller numbers:

Again, it can be seen quite clearly that even at 200 transactions a month, you are already saving about N$8000.00. It should be abundantly clear that 2Checkout charges significantly more than Peach Payments.

Click here to download the Excel File used to generate the graphs above. This will allow you to tweak the number of transactions and find answers for your specific scenario.

What other benefits does Peach Payments offer?

One of the coolest features of Peach Payments is that they don't require anything fancy in order to do processing without going off-site. In other words, the user won't first be directed to 2checkout.com (or some other off-site link) and do anything on that page because everything happens on your website!

How do I integrate Peach Payments on my website?

This varies from implementation to implementation. If you need help implementing the Peach Payments Payment Gateway, please contact Namhost for more assistance.

UPDATE (3 March 2015)

Peach Payments is still finalizing a few licensing requirements on their side and, as a result, will only accept new applications in a few weeks.

UPDATE (4 March 2015)

I did receive some feedback with regards to the Compliancy. This is what I was told:

In terms of compliance we are fully compliant and PCI Level 1 certified.

The way we embed on the merchant’s page is using a JS widget. This allows the user to enter the card data into a widget that is actually directly hosted by us and not by the merchant.

We can also additionally enable mini frames within the widget that will ensure that even the fields where the user enters the card data come from our servers in their entirety. This would then allow merchants to comply with PCI DSS 3.0 as well and qualify for the SAQ – A based certification process.

So overall, our entire solution is fully compliant and is very similar to a Stripe like experience.

UPDATE (19 March 2015)

We are almost finished with our integration of Peach Payments. Below is a screenshot of what it will look like:

The best part is still that once the user clicks "pay now", they are transferred to the thank you page onsite. You will not first go off-site and complete the transaction on another website. This has some really nifty benefits:

- The user will feel more secure if they remain in one environment

- Your branding remains intact and you don't have to advertise another company each time you make a sale.

- It's fast! (With 2checkout the user had to enter all their details again or still double check it even if it is pre-populated)